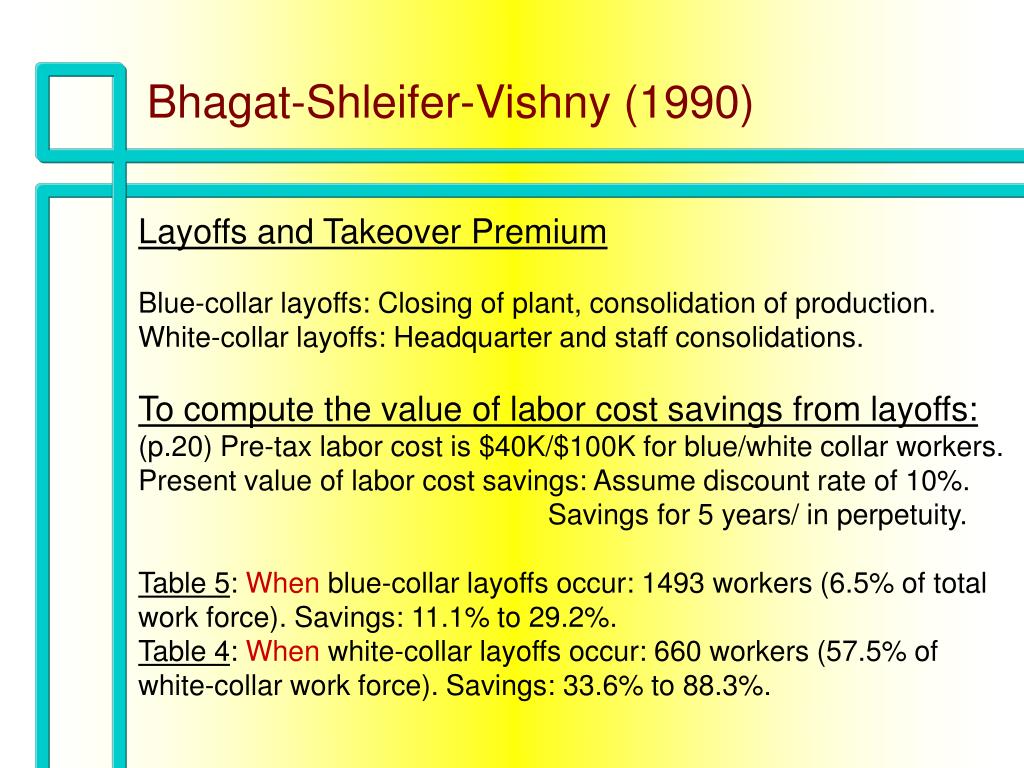

PPT BhagatShleiferVishny (1990) PowerPoint Presentation, free download ID1159847

Robert W. Vishny. Shleifer is from Harvard University. Vishny is from the University of Chicago. Prepared for the Nobel Symposium on Law and Finance, Stockholm, August 1995.. June 1997. Pages 737-783. References; Related; Information; Close Figure Viewer. Return to Figure. Previous Figure Next Figure. Caption. Download PDF.

The Grabbing Hand Government Pathologies and Their Cures (9780674010147) Andrei Shleifer and

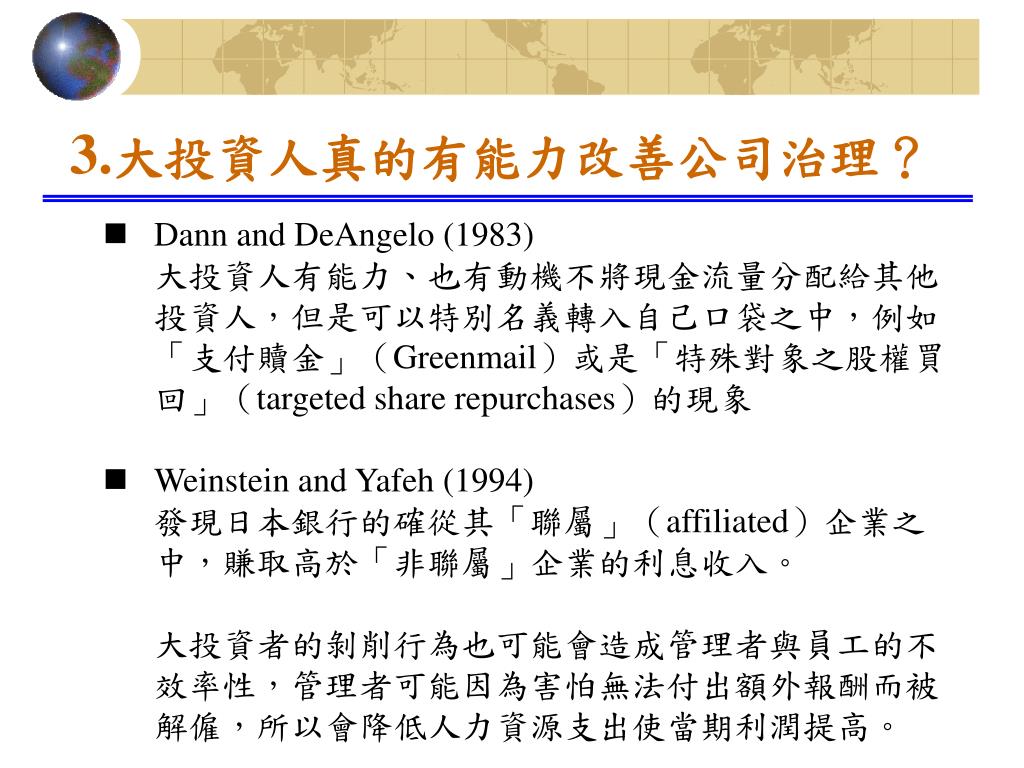

A Survey of Corporate Governance. Andrei Shleifer, Robert W. Vishny. 31 May 1997 - Journal of Finance (Wiley-Blackwell) - Vol. 52, Iss: 2, pp 737-783. TL;DR: Corporate Governance as mentioned in this paper surveys research on corporate governance, with special attention to the importance of legal protection of investors and of ownership.

PPT BhagatShleiferVishny (1990) PowerPoint Presentation, free download ID1159847

Created Date: 20060227160045Z

La Porta, R., F. LopezdeSilanes, A. Shleifer, and R. W. Vishny. 1997. “Legal Determinants of

A Survey of Corporate Governance Citation Shleifer, Andrei, and Robert W. Vishny. 1997. A Survey of Corporate Governance. The Journal of Finance 52, no. 2: 737-783.

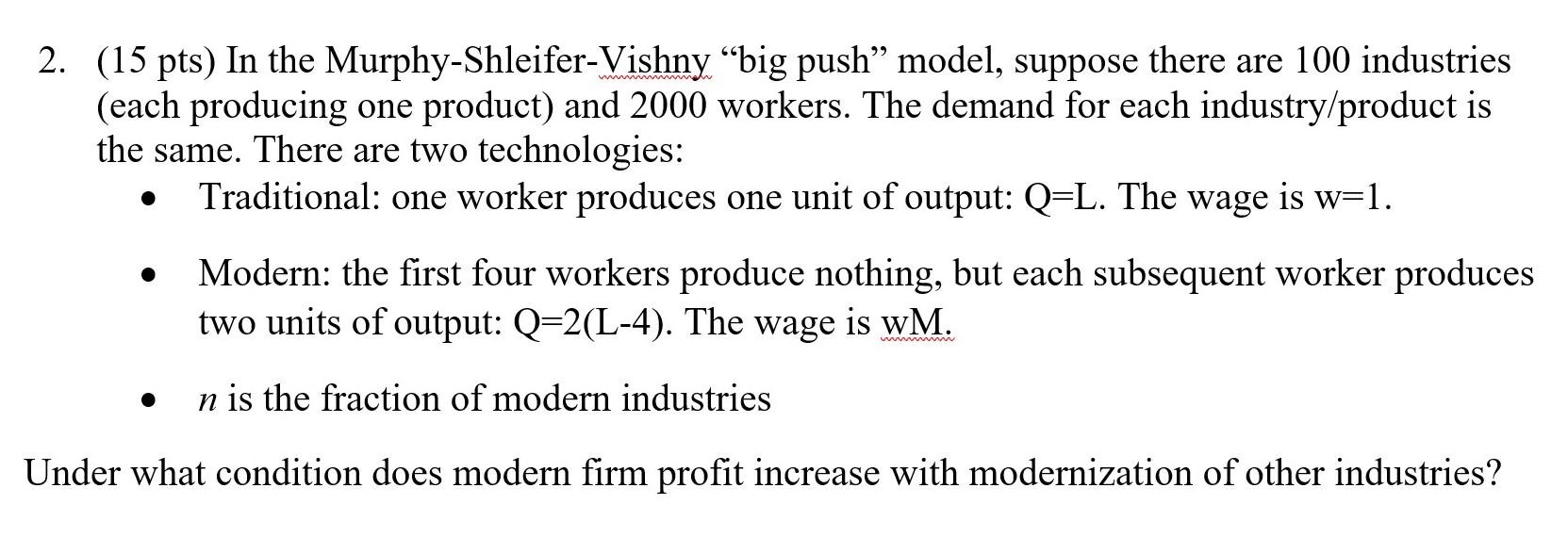

2 15 pts in the murphyshleifervishny big push model suppose there are 100 indus StudyX

A Survey of Corporate Governance. Andrei Shleifer & Robert W. Vishny. Working Paper 5554. DOI 10.3386/w5554. Issue Date April 1996. This paper surveys research on corporate governance, with special attention to the importance of legal protection of investors and of ownership concentration in corporate governance systems around the world.

Основы Корпоративного Управления к э н преп

Reprinted in Robert Cooter and Francesco Parisi, eds., Recent Developments in Law and Economics, Edward Elgar Publishing Company, 2010. Shleifer, Andrei, and Robert W Vishny. 1997. "A Survey of Corporate Governance.". Journal of Finance 52 (2): 737-783.

Muhammad Tamrin 2017 In their classic survey of corporate governance, Shleifer & Vishny (1997

The Limits of Arbitrage. Andrei Shleifer, Robert W. Vishny. Published 1 July 1995. Economics. NBER Working Paper Series. In traditional models, arbitrage in a given security is performed by a large number of diversified investors taking small positions against its mispricing. In reality, however, arbitrage is conducted by a relatively small.

PPT BhagatShleiferVishny (1990) PowerPoint Presentation, free download ID1159847

ROBERT W. VISHNY. La Porta, Lopez-de-Silanes, and Shleifer are from Harvard University, and Vishny is from the University of Chicago. We are grateful to Alex Chang, Mark Chen, and Magdalena Lopez-Morton for research assistance, to Ed Glaeser, Stewart Myers, and Luigi Zingales for helpful comments, and to the HIID and the National Science Foundation for support of this research.

Limits of Arbitrage by Shleifer Vishny The Limits of Arbitrage Author(s) Andrei Shleifer and

LII, NO. 1 MARCH 1997 The Limits of Arbitrage ANDRE1 SHLEIFER and ROBERT W. VISHNY* ABSTRACT Textbook arbitrage in financial markets requires no capital and entails no risk. In reality, almost all arbitrage requires capital, and is typically risky. Moreover, pro-fessional arbitrage is conducted by a relatively small number of highly specialized

A model of investor sentiment Barberis, Shleifer & Vishny Journal of Financial Economics,1998

Shleifer and Vishny (1997) and LLSV (1996) focus on the legal solutions to agency problems between entrepreneurs and investors, and in particular emphasize the cross country differences in these solutions. Modigliani and Perotti (1996) also focus on contract enforcement as a determinant of external finance, and in particular stress the choice.

Shleifer and Vishny Summary Corruption Shleifer and Vishny Corruption outline The authors

Shleifer is from Harvard University and Vishny is from The University of Chicago. Nancy Zimmerman and Gabe Sunshine have helped us to understand arbitrage. We thank Yacine Aït Sahalia, Douglas Diamond, Oliver Hart, Steve Kaplan, Raghu Rajan, Jésus Saa-Requejo, Luigi Zingales, Jeff Zwiebel, and especially Matthew Ellman, Gustavo Nombela, René.

(PDF) The Limits of Arbitrage Shleifer and Vishny 1997 dirk dirkson Academia.edu

LaPorta, Rafael, Florencio Lopez-de-Silanes, Andrei Shleifer, and Robert W Vishny. 1997. "Trust in Large Organizations." American Economic Review Papers and Proceedings 87 (2): 333-338.

(PDF) Anything is Possible On the Existence and Uniqueness of Equilibria in the ShleiferVishny

Andrei Shleifer!,*, Robert Vishny#!Department of Economics, Harvard University, Cambridge, MA 02138, USA. 1997, 1998). When investor rightssuch as the voting rights of the shareholders and the reorganization and liquidation rights of the creditors are extensive and well enforced by regulators or courts,

委托—代理视角下的跨国公司海外子公司人员外派动因理论探析_word文档在线阅读与下载_免费文档

A Survey of Corporate Governance. Andrei Shleifer, Robert W. Vishny. Published 1 April 1996. Business, Law, Economics. Organizations & Markets eJournal. This article surveys research on corporate governance, with special attention to the importance of legal protection of investors and of ownership concentration in corporate governance systems.

The Limits to Arbitrage Shleifer and Vishny FINA 4329 StuDocu

Shleifer, Andrei, and Robert W Vishny. 1997. "The Limits of Arbitrage." Journal of Finance 52 (1): 35-55.

PPT 公司治理 Shleifer & Vishny (1997,JF) PowerPoint Presentation ID3898448

THE JOURNAL OF FINANCE . VOL. LII, NO. 2 . JUNE 1997 A Survey of Corporate Governance ANDREI SHLEIFER and ROBERT W. VISHNY* ABSTRACT This article surveys research on corporate governance, with special attention to the importance of legal protection of investors and of ownership concentration in corpo-rate governance systems around the world.